|

|

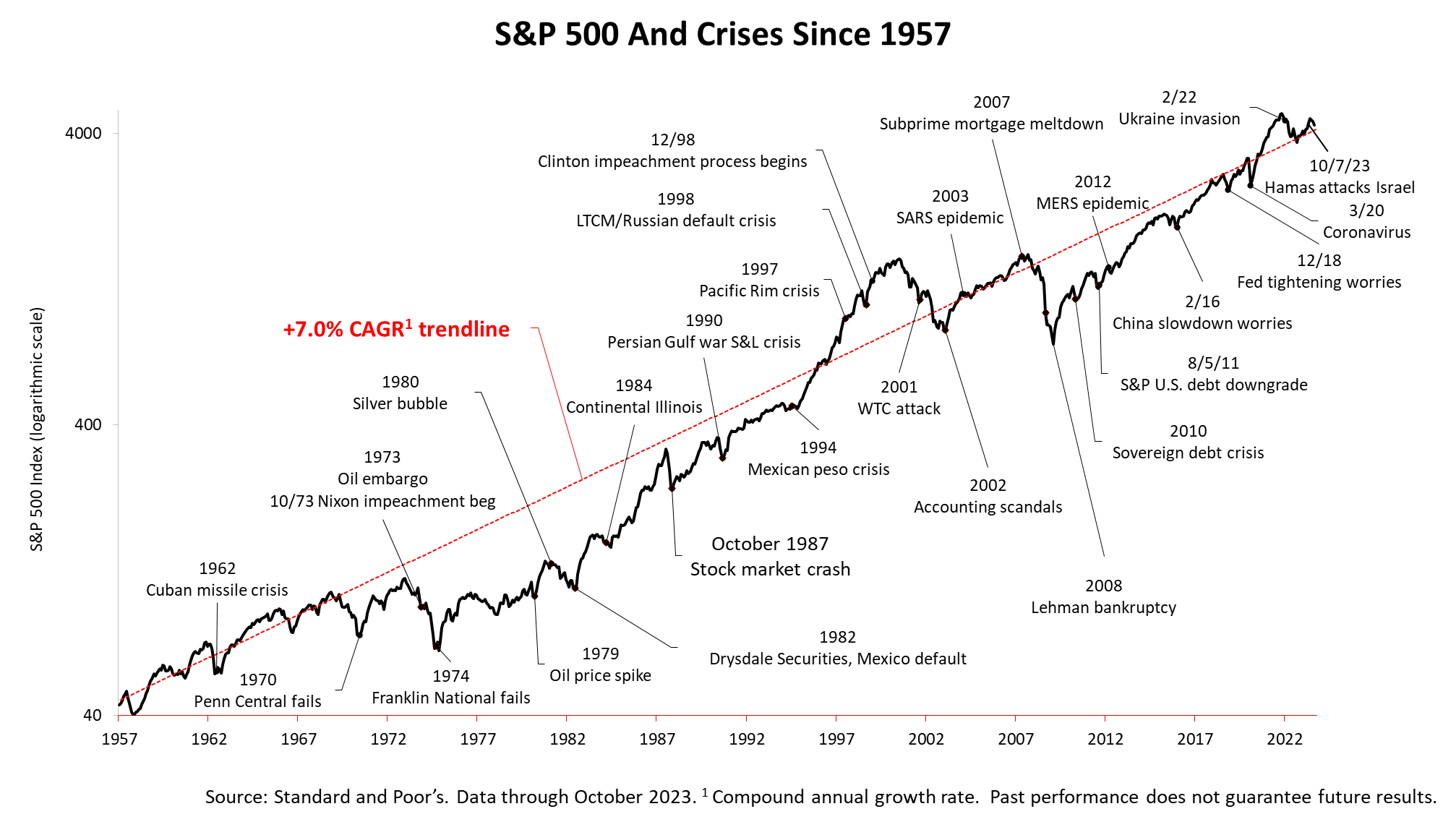

Amid A Confluence Of Crises, Keep Financial History Top Of Mind

|

|

Amid the Mideast war, Ukraine military stalemate with Russia, and rising tensions with China over Taiwan, it’s important to remember that the modern era has been in crisis almost perpetually, and the U.S. stock market has continued to rise anyway. People tend to assume what’s happening in the world now is going to continue and this can result in making bad investment decisions. Behavioral economics even has a name for this human foible: recency bias. So here are key facts to remember in this time of geopolitical turbulence.

The Standard & Poor’s 500 stock index since 1957 has grown at a compounded annual rate of 7%. And that’s without reinvesting dividends earned on stocks, which would boost the average annual growth rate to about 10.5% annually. This chart could easily contain many more crises, such as the November 1963 assassination of President John F. Kennedy, the fall of Saigon in April 1975, the Brexit referendum in June 2016, and the bursting of the tech bubble in 2000. But you get the idea from this collection of crises. Things could be different this time, which is why securities regulators insist on mentioning that past performance is not a guarantee of future investment results. However, it’s also important to remember amid current geopolitical crises that bad events came and went in recent decades, but the Standard & Poor’s 500 stock index, a benchmark of American progress, kept appreciating anyway. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |

|

|

| This article was written by a professional financial journalist for Responsive Financial Group, Inc and is not intended as legal or investment advice. |

|

| ©2024 Advisor Products Inc. All Rights Reserved. |

|

|

|

|

|